Medical aesthetics is a cool, $20bn niche within the healthcare ecosystem. As I wrote last week, there are massive tailwinds behind medical aesthetics that should propel outsized growth for industry participants. In recent months, there has been a lot of interesting capital markets activity in the industry as well - e.g. the $SKIN SPAC deal led by the former CEO of Allergan, Valeant/Bausch’s forthcoming spinout of Solta. As an aspiring (emphasis) beautiful person myself, I wanted to take a stab at mapping out the space to better understand the dynamics at play (it’s called learning in public 😤😤).

In the Eye of the Beholder…

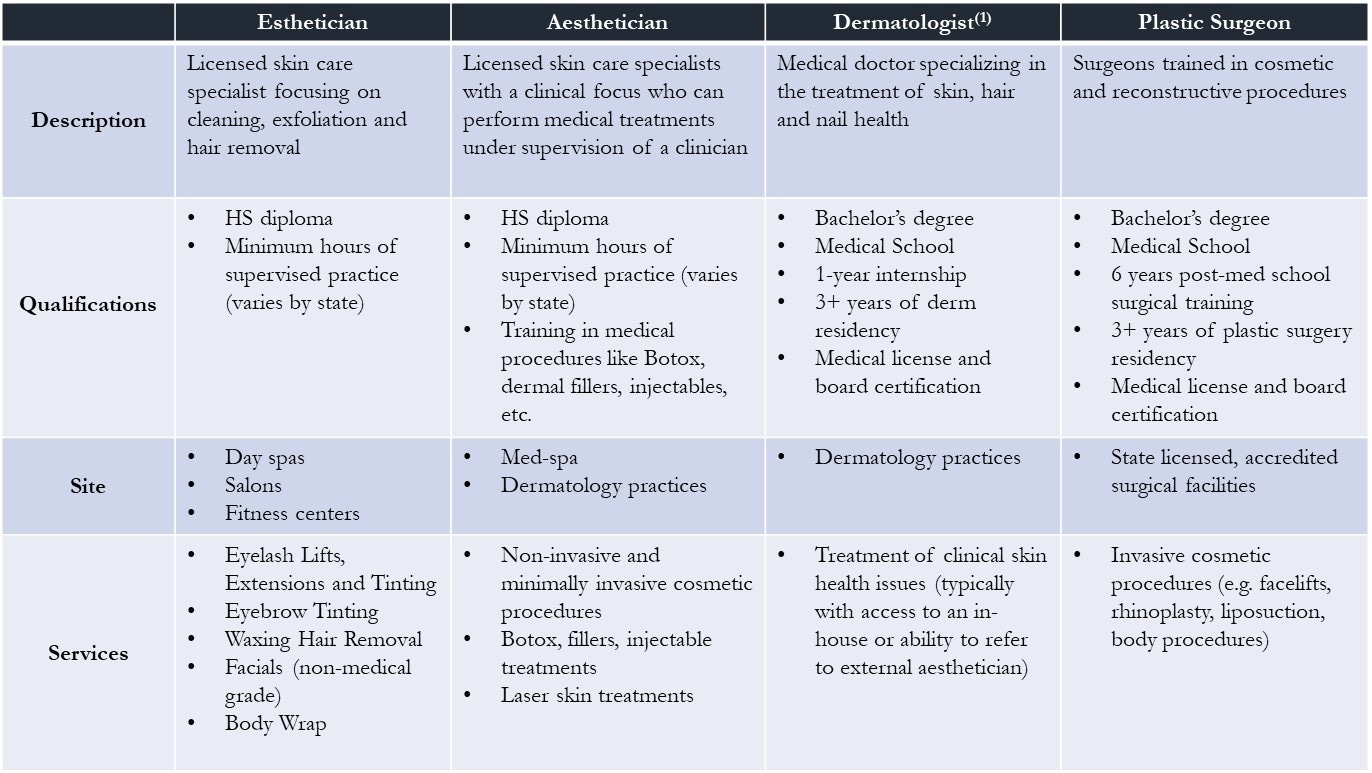

The first challenge in dissecting the medical aesthetics industry is deciding where it starts and ends. The overarching beauty economy is complex and encompasses a ton of sub verticals - e.g. fitness/wellness, consumer beauty products, fashion. Furthermore, the swim lanes between medical aesthetics and consumer cosmetic/beauty companies are often obfuscated. Just to illustrate how confusing this can be: there is actually a difference between “aestheticians” and “estheticians.”

It’s also confusing because whereas medical aesthetics is mostly about how you look, there are a number of acute and chronic skin health conditions that require treatment by trained dermatologists; in some ways we could consider these skin health issues to be related to aesthetics because skin conditions are inherently visible. It’s even hard to distinguish where medical aesthetics services can be provided, as the American Med Spa Association comments:

There are laser hair removal facilities that do not perform surgical procedures. There are dermatologists who may perform tattoo removal. There are facilities where an MD is on site or in a supervisory position, overseeing aestheticians. And there are “day spas” that invite a local physician or nurse to do Botox injections one day a week. There are also hospitals, wellness centers and laser centers. All these examples may operate under the title of “medical spa.”

Source: American Med Spa Association, 2017

To draw some lines in the sand, when I refer to medical aesthetics, I am excluding both retail consumer beauty and clinical dermatology, as illustrated below.

Source: American Med Spa Association, American Board of Cosmetic Surgery, Piper Sandler Research

Medical aesthetics services as I’ve defined them would fall under the scope of aestheticians (with the “a”), dermatologists and surgeons. An important point - while aestheticians can perform most non-invasive and minimally-invasive procedures, they must typically be performed under the supervision of a licensed physician and most states require that patients complete a medical exam with a clinician (dermatologist or mid-level practitioner) prior to receiving a medical aesthetics treatment (though strict adherence to this protocol across the industry appears to be suspect).

Source: Indeed, National Laser Institute, American Academy of Dermatology, American Society of Plastic Surgeons

Biomedical Innovation + Cash Pay = $$$

Medical aesthetics companies sit at the nexus of consumerism and biotechnology, benefitting from a powerful combination of 1) the ability to create clinically validated, highly-moated IP and 2) the ability to monetize that IP entirely on a cash-pay basis.

This is a sharp contrast to other forms of biotech innovation (e.g. pharmaceutical products) where even mission critical, highly differentiated products/services (e.g. rare disease drugs) are subject to intense scrutiny by third-party payors who want to see hard data around outcomes. Even after running the clinical regulatory gauntlet with bodies like the FDA, pharma medical affairs teams rigorously defend their products by leveraging post-market surveillance and real-world data in negotiations with payors around pricing and coverage.

In medical aesthetics, the consumer is the payor which enables companies in the space to benefit from a fast, low-friction sales process with no reimbursement risk and the rapidly expanding experience economy in healthcare trends. Medical aesthetics procedures are high-ticket revenue items - the average aesthetics customer spends $300-500 per visit to a med spa, and 70% of visits come from repeat customers (American Med Spa Association, 2017). They also exhibit a greater propensity to buy retail take-home products from dermatologists and med spas.

A perfect illustration of the distinct selling dynamic in medical aesthetics is Botox parties:

Botox parties are the latest marketing gimmick by dermatologists, plastic surgeons and other doctors who see it as a way to treat many patients at once -- and as a way to create a buzz and more business. These intimate, though controversial, private gatherings redefine the notion of house calls. For patients, mixing cocktail hour with cosmetic injections takes some of the anxiety out of the procedure. And for doctors, providing Botox to as many as 10 patients in less than 60 minutes offers a potential financial boon. The treatment costs between $250 and $1,000, and must be repeated every three-to-six months.

The Botox beauty bashes seem to have started in Los Angeles, but have quickly spread across the nation, from the Upper East Side of Manhattan to the wealthy suburban enclaves around Seattle.

"Ours was just so fabulous," says Ms. Brown, 32 years old, who held her first Botox party last week with 10 friends, over champagne, chocolate truffles and brie. "The private setting makes it so relaxed -- it didn't feel so much like it was this big procedure."

For Dr. Joseph Eviatar, an ocular plastic surgeon at the Chelsea Eye Center, in lower Manhattan, the idea of the Botox party dawned on him last summer, when all of his clients fled the city. "Someone said, 'Why not do it in the Hamptons?"' So, last August, the doctor held a Botox party at his own home in Southampton, N.Y. After a brief discussion about benefits and potential risks, everyone starts drinking, Dr. Eviator says. "It really takes the edge off."

His next party is Tuesday night in Manhattan, at the home of his public relations consultant, Katherine Rothman. Claire Cowan, a freelance fashion stylist, plans to attend with a few friends. "I don't want to show any signs of aging," says Ms. Cowan, 33. "And I thought this would be a fun way to be around other women, maybe a few men, and have some good camaraderie." Moreover, she says: "I'm hoping a party at a private home will have less of that sterile office feel."

Source: Wall Street Journal (April 2002)

The existence of Botox parties is nuts, especially compared to conventional pharma go-to-market strategies. Sure, conventional pharma companies might leverage patient education and patient support groups to market their products, but could you imagine a prescriber throwing a party for any other pharmaceutical product?

Only Skin Deep

The sheer number of appearance-improving services and products that exist within the umbrella of medical aesthetics is mind-blowing. There are a few ways to wrap your arms around the components of the industry.

The most intuitive approach is to go body-part by body-part. These fun choose-your-own-adventure guides from the American Board of Cosmetic Surgery below illustrate the array of non-surgical treatments you can undergo to address specific skin and body shape concerns. The lists exclude the numerous invasive surgery treatments that a cosmetic surgeon could provide.

Source: American Board of Cosmetic Surgery

To understand the mix across these various products and services, we can look at treatment volume by category across med spas nationwide as documented below. Botox, while trailing slightly on volume, tends to be the largest revenue driver for medical aesthetics practices.

Going a layer deeper, there are numerous competitors in just about every subcategory of the aesthetics ecosystem.

My tiny pea-sized VC investor brain can only consume competitive landscapes in the form of market maps with little colorful boxes so I’ve started to draw out the market as I see it below. P.S. if you see something that looks off already, let me know.

The industry has upstarts and one-hit-wonders. It also has consolidators and a few powerhouse players (e.g. Allergan/Abbvie, Inmode). Many different business models exist across this generally high-margin value chain. Some companies focus solely on manufacturing and selling equipment. Others employ a razor-razorblade model to sell equipment + variable consumables to providers. There are multi-unit brick-and-mortar models and even dedicated vertical SaaS companies as well. I’m out of time for now but in part two, I’ll get into the value-chain and the constituents of the industry in greater detail…

Disclaimer:

This content is being made available for educational purposes only and should not be used for any other purpose. The information contained herein does not constitute and should not be construed as investment advice, an offering of advisory services, or an offer to sell or solicitation to buy any securities or related financial instruments in any jurisdiction. Certain information contained herein concerning economic trends and performance is based on or derived from information provided by independent third-party sources. The author believes that the sources from which such information has been obtained are reliable; however, the author cannot guarantee the accuracy of such information and has not independently verified the accuracy or completeness of such information or the assumptions on which such information is based.

Hi, not sure if you remember me from good ole DW & SHS days, this is Melinda Choi. Was looking back at some old Facebook photos and thought "gee, whatever happened to that guy?"; anyway, glad I didn't find a mugshot and instead you're writing on topics way above my head. I decided to forgo making real $$ after college and instead read some heavy ass books; now I'm a plastic surgery resident in Miami. Since I'm living in the land of plentiful plastic surgery and medical aesthetics, it doesn't surprise me how fast this sector is growing. Certainly social media is an enormous driver of this (not sure how else we could've convinced young, slim women to make their hips/butts LARGER otherwise...even at the risk of death). The trend cycling is astounding. As residents we receive free injectable products to administer to whomever; kind of a hook 'em early strategy courtesy of Allergan under the guise of "resident education" and learning how to inject their product. The aesthetic/injectable side of a plastic surgery practice is certainly an easy way for plastic surgeons to build their patient roster and also be the first surgeon a patient will speak to if he/she wants an invasive procedure. Any wise plastic surgeon probably won't be spending time injecting all day and instead delegate to a nurse injector/midlevel provider while the surgeon either operates or sees surgical consultations. I've often wondered why someone hasn't branded or franchised this low hanging fruit. The Orange Theory or Soul Cycle of med spas if you will. Looking forward to part 2...

This is really comprehensive - thanks for writing it!