There is an accelerating convergence in the ways that people buy & use healthcare goods/services with the ways that they buy & use goods/services in other consumer-first industries (retail, travel, media/entertainment etc.).

More eloquent people have offered this up as the “Consumerization of Healthcare.”

Consumerize Me, Captain

Here are a few examples where we can see this today:

Digitally Native Verticalized D2C Health Companies

One of the most visible examples of consumerization in healthcare is the advent of chronic condition-specific healthcare models like Thirty Madison, Ro, Hims. These companies provide telemedicine + pharmacy fulfillment over-the-top directly to customers to help manage ongoing conditions like hair loss, allergies, acid reflux, etc. The value proposition to customers is a fast, seamless and discrete end-to-end experience to get medication/treatment for their chronic conditions.

Membership Based Primary Care

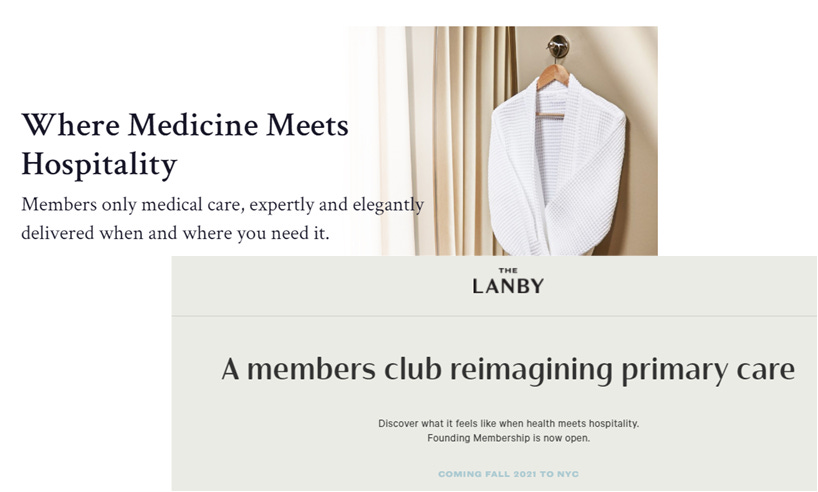

We have seen the emergence of new models in primary care, including concierge medicine (lower membership fee, company bills your insurance - e.g. OneMedical) and direct primary care (higher fees, no billing your insurance - e.g. Forward Health). These models typically utilize D2C marketing channels to find and convert individual members. The value proposition advertised to prospective members is better quality of care driven by higher frequency, longer duration visits with your primary care physician (in a beautiful office or via a seamless telemedicine app)+ other “goodies” like care navigation or streamlined access to specialty care.

The non-healthcare analogue here might be any number of closed-network membership-based experiences: luxury gyms like Equinox, private clubs like Soho House. Startups like Sollis Health and The Lanby have deployed this members-club mystique in their messaging:

Wearables

Wearable fitness trackers (Apple Watch, Oura, Whoop, Fitbit) offer robust tools to measure and monitor key vitals. These devices have historically been relegated to the category of consumer “wellness” because of the onerous FDA clearance process required for clinical use cases. Now, there is a line of sight to a confluence of consumer-grade devices and clinical use cases, with recent examples like the FDA’s clearance of Fitbits and Apple Watches for EKG. Conversely, clinical-grade device makers are taking cues from their consumer-focused peers and making their products/devices more consumer-y. For example, Omron recently released a blood pressure monitor that looks a lot like a consumer-grade smart watch.

As this consumerization trend progresses, the touchpoints between healthcare providers and patients will increase. One of the implications of this may be the emergence of “experience economy” conditions within components of the healthcare continuum.

“There is only one boss. The customer.”

What is an experience economy? B. Joseph Pine II and James H. Gilmore explain in this 1998 HBR article:

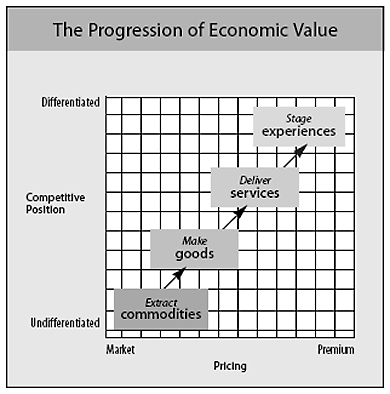

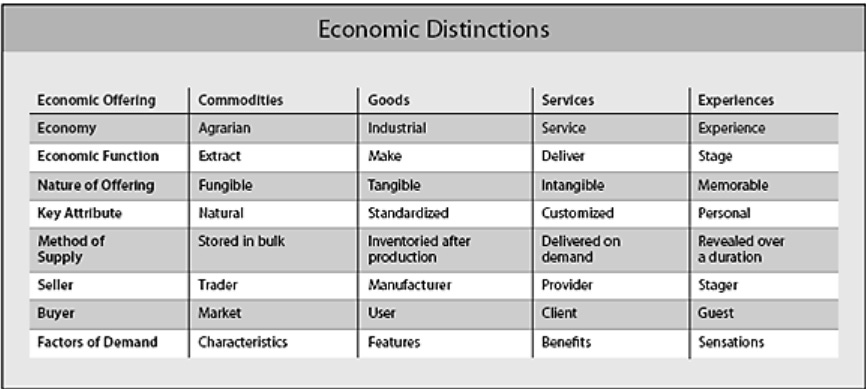

Economists have typically lumped experiences in with services, but experiences are a distinct economic offering, as different from services as services are from goods. Today we can identify and describe this fourth economic offering because consumers unquestionably desire experiences, and more and more businesses are responding by explicitly designing and promoting them. As services, like goods before them, increasingly become commoditized—think of long-distance telephone services sold solely on price—experiences have emerged as the next step in what we call the progression of economic value. (See the exhibit “The Progression of Economic Value.”) From now on, leading-edge companies—whether they sell to consumers or businesses—will find that the next competitive battleground lies in staging experiences.

…An experience occurs when a company intentionally uses services as the stage, and goods as props, to engage individual customers in a way that creates a memorable event. Commodities are fungible, goods tangible, services intangible, and experiences memorable…

… companies stage an experience whenever they engage customers in a personal, memorable way.

Just one quick aside - this description of Rainforest Cafe is just poetic:

The mist at the Rainforest Cafe appeals serially to all five senses. It is first apparent as a sound: Sss-sss-zzz. Then you see the mist rising from the rocks and feel it soft and cool against your skin. Finally, you smell its tropical essence, and you taste (or imagine that you do) its freshness. What you can’t be is unaffected by the mist.

The notion of consumer “sensations” driving purchases in experience markets is an interesting idea. As healthcare companies elevate their offerings from services to experiences, it’s the sensation of care that they need patients to feel.

For a real-world example of this “sensation” dynamic, we can look to the evolution of the CMS Star Ratings Program. CMS rates Medicare Advantage and Prescription Drug Plans from 1-5 stars based on the ratings system explained here:

CMS created the Part C & D Star Ratings to provide quality and performance information to Medicare beneficiaries to assist them in choosing their health and drug services during the annual fall open enrollment period…

The Star Ratings include measures applying to the following five broad categories:

Outcomes: Outcome measures reflect improvements in a beneficiary’s health and are central to assessing quality of care.

Intermediate outcomes: Intermediate outcome measures reflect actions taken which can assist in improving a beneficiary’s health status. Diabetes Care – Blood Sugar Controlled is an example of an intermediate outcome measure where the related outcome of interest would be better health status for beneficiaries with diabetes.

Patient experience: Patient experience measures reflect beneficiaries’ perspectives of the care they received.

Access: Access measures reflect processes and issues that could create barriers to receiving needed care. Plan Makes Timely Decisions about Appeals is an example of an access measure.

Process: Process measures capture the health care services provided to beneficiaries which can assist in maintaining, monitoring, or improving their health status.

Source: CMS Medicare 2021 Part C & D Star Ratings Technical Notes

CMS recently decided to swing the weighting of these five categories away from outcomes measures (e.g. did the plan close specific member care gaps in a given year) and toward patient experience measures (e.g. patient surveys on their experience with the health plan).

Centers for Medicare and Medicaid Services (CMS) has announced some key changes to the Medicare Advantage (MA) Star Ratings formula for contract year 2021, which impact 2023 Star Rating scores. The changes put the spotlight and emphasis on Consumer Assessment of Healthcare Providers and Systems (CAHPS®) surveys, which are usually conducted annually each spring. CAHPS scores will be quadruple-weighted, which means they will represent 32% of the overall Star Rating weighting for contract year 2021.

CAHPS surveys ask beneficiaries (or caregivers) about their experience with, and ratings of, their providers (e.g., hospitals, home health care, hospitals) and health plans. The consumer experience entails all the interactions an individual has with your plan and their perception of whether those interactions are overall positive or negative. Their experience breaks down to three things:

How easy it is to access care

Communication from providers

How well consumers understand medication information

Source: Adhere Health Blog Post

CAHPS is like an NPS score for Medicare plans. Its growing importance echoes the changes across the healthcare continuum which are increasing emphasis on patient experience.

The broad implication for healthcare companies is that patient experience will be a key lever of value creation and capture going forward. In order to better manage the patient experience, they will need to better monitor the patient experience. That means communicating with patients more frequently across more touchpoints.

And to ensure communications across the growing number of touchpoints with customers are working, they will need to listen more effectively to customers. That means that mining the “voice of customer” which is common in other industries (e.g. Qualtrics surveys), will be critical in identifying pain points along the customer journey.

Ultimately, the juice should be well worth the squeeze; companies that are able to harness the “experience economy” will benefit from brand value creation, enhanced pricing power and improved customer stickiness (yielding superior margins and profitability downstream) which can be seen in leading brands in other industries.

Constraints to Change

Excitement about these trends should be tempered - the scope for consumerization is constrained by a several parameters related to patients’ bargaining power:

Is the patient actually the customer?

Healthcare good/service providers selling directly to patients and caring about their experience is most applicable where the patient is the “buyer.”

That is not always (or even usually) the case. For example, consumerization is unlikely to apply where care is provided to captive patient populations (e.g. skilled nursing or senior living facilities, correctional institutions, self-insured employers). In these settings, the buyers are typically facility-level or organization-wide decision makers. Patient experience is probably an important piece of the decision criteria for these buyers, but they have to manage other pressing interests beyond patient satisfaction/experience (e.g. $$$).

If I’m not selling directly to you, I’m probably not as focused on pleasing you.

Can the patient pay for the good/service (either out-of-pocket or with their insurance coverage)?

Like everything, your freedom to select providers depends on your ability to pay. Competing on experience is less relevant when patients are constrained by their inability to pay out-of-pocket. For example, if you’re part of an HMO, you get to choose your specific provider, but you’re restricted to the selection of doctors that have contracted with your health plan.

Those providers might compete somewhat on patient experience, but not to the level that the aforementioned D2C primary care companies do. You can see it in their messaging:

Source: OneMedical, Crossover

How acute/urgent/episodic is the patient’s need (i.e. how much time does a patient have to pick a provider)?

The acuity/urgency of the care that you need also determines your ability to be selective. If you are experiencing an emergency episode - like a heart attack - your decision criteria would be proximity and wait-times to receive adequate care (you’re probably not going to be shopping around for ER’s in the moment). In general, consumerization is less relevant in managing episodic issues vs. chronic conditions, just based on the time-scale of decision-making.

A great example of how these parameters work to constrain or unlock consumerization in healthcare is substance abuse care.

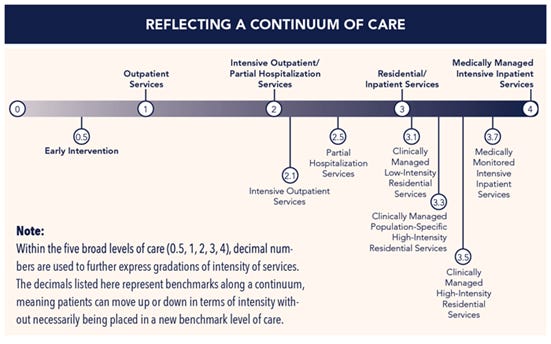

Starting with urgency, substance abuse patients can be categorized on a continuum of care based on their acuity. Your current level of intoxication or withdrawal symptoms can inform your immediate care options. If you are experiencing extreme withdrawal symptoms (Level 4 on the ASAM scale below), then you’re limited to inpatient care at a hospital ER (no choice). Ability to pay will have limited influence in this setting.

Source: American Association of Addiction Medicine

If you have less extreme, but still severe withdrawal symptoms, you will need treatment in a facility that can provide level 3+ detox care. Here you might have some, but generally limited choices (just based on local supply), and your ability to pay / insurance coverage will constrain your choices (e.g. if you are on Medicaid, detox bed supply is severely limited).

If you don’t have presently have withdrawal symptoms (or you’ve already completed detox in a hospital/standalone facility), you have a lot of choices as to where to seek rehab care (inpatient vs. outpatient, basic vs. luxury). Your ability to pay matters a lot in determining your options for care; if you can pay out-of-pocket, you can go anywhere vs. having to stay in-network with your insurance plan.

Not surprisingly, it is on the cash-pay rehab side where we see the most competition on patient experience. For example, ultra-luxe facilities competing for wealthy, high out-of-pocket spend patients tout offerings that range from the grandiose (5-star accommodations) to the absurd (equine therapy).

Patients —> Party Guests

While there are limits to its scope, the trend of healthcare companies increasing touchpoints directly with patients offers significant opportunity for these companies to drive and own better patient experiences while creating and capturing more value.

Healthcare organizations will be well-served by looking at peers in other industries with customer-first philosophies for learnings that they can leverage to craft their own durable brand power.

“We see our customers as invited guests to a party, and we are the hosts. It’s our job every day to make every important aspect of the customer experience a little bit better.” – Jeff Bezos

Disclaimer:

This content is being made available for educational purposes only and should not be used for any other purpose. The information contained herein does not constitute and should not be construed as an offering of advisory services or an offer to sell or solicitation to buy any securities or related financial instruments in any jurisdiction. Certain information contained herein concerning economic trends and performance is based on or derived from information provided by independent third-party sources. The author believes that the sources from which such information has been obtained are reliable; however, the author cannot guarantee the accuracy of such information and has not independently verified the accuracy or completeness of such information or the assumptions on which such information is based.