Mt. Rushmores (Part 2 - Executives)

Capitalist simping continued

Continuing my list of fascinations (part 1 featuring Costco, Epic Systems, Renaissance Technologies and Major Food Group here), here are four executives that I find to be the most fascinating.

II. Executives

Mark Zuckerberg

Fascinating because: Zuckerberg is the prototypical tech founder of the internet age.

Mark Zuckerberg is THE archetypal founder of the consumer internet age that I grew up in. Meta’s transformation from quirky dorm room side project into a digital narcotics cartel advertising cash machine is a creation myth for the modern technology industry. A lot of tech culture is built on Meta/Zuckerberg’s foundation - the product focused founder CEO, “move fast and break things,” having a “growth” team.

The most interesting aspect of Mark Zuckerberg as an executive is the control that he has over Facebook because of the dual-class stock structure. His superpower is that, unlike basically every other public company CEO, he cannot be fired.

This enables an unparalleled decisiveness - illustrated in situations like the Yahoo/Microsoft buyout offers and the transformative M&A deals in the Company’s history. The biggest advantage of this dynamic is that Zuckerberg can underwrite to time horizons that far exceed the typical CEO; other CEOs have to be fixated on the next quarter, Zuckerberg can plan for the next decade.

This job security has enabled Zuckerberg to mature through multiple phases of his tenure at the helm. There are Eras of Zuckerberg. Melting down servers at Harvard Zuckerberg, turning down $1bn to bet on himself Zuckerberg, getting yelled at by Congress Zuckerberg, and current edition UFC/wakeboarding/startups-need-to-be-on-TRT Zuckerberg.

And he is still so young. It’s crazy to think that his best days might yet be ahead.

Personally I am here for the Amiri collab, Porsche pimpin’ era of Zuckerberg. I have been wondering why he’s become much more prolific with his public persona, including the recent shift to “tech-right” political narratives (oh nooo DEI is killing my company, it was only able to add $1 trillion in market cap over the past 5 years😔😔).

In this era, I see strategic decisions from a noted strategy game enthusiast to position Meta to survive the next phase of the Company’s life. If I had to guess, Zuckerberg is looking at Elon Musk and seeing that his larger-than-life cult of personality serves as a foundational support to the his companies’ stock prices and ability to fundraise. He probably wants some of that action to bolster his own position on some of the Company’s longer duration bets. The political movements track with how he has operated in response to government/regulatory pressure in the past. We had the very demure version of Mark Zuckerberg and the Company during the high-scrutiny Cambridge Analytica fallout phase because that was necessary for survival. Similarly, I think he now sees an administration that is transparently open-for-business and one where perceived loyalty will forgive all manner of corporate harm by consumer-tech companies (please ban tik tok).

I am sure that Mark Zuckerberg’s tenure as CEO of Meta will continue to fascinate me. That being said, I do think he should be arrested for putting this into the world:

Barry Diller

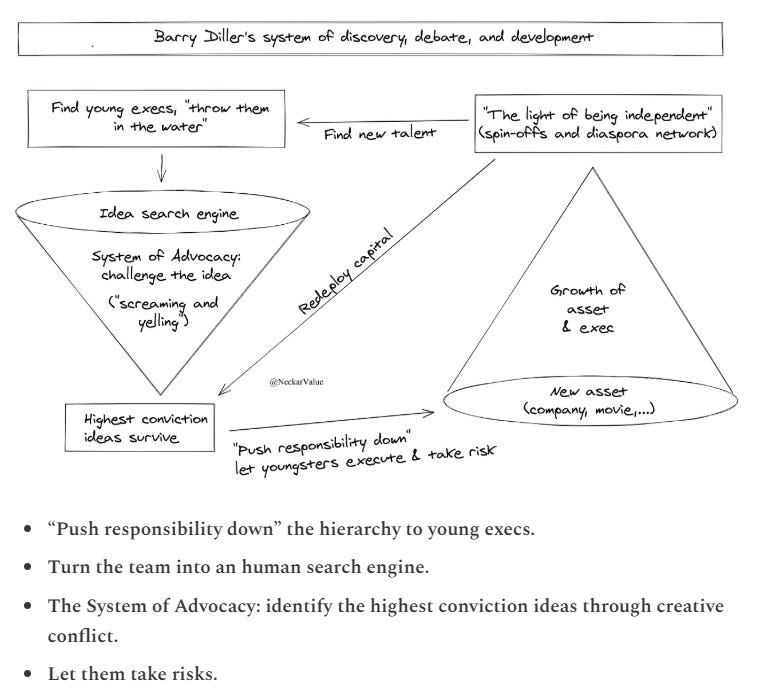

Fascinating because: Diller’s management style of cultivating talent by pushing responsibility down resonates with me.

Barry Diller is a media powerhouse. His career spans ABC to Paramount, founding FOX with Rupert Murdoch, Building QVC and then InterActiveCorp.

He is well known, in particular, for his style of management. Frederik Gieschen captures the "Diller System” really well:

Diller cultivated so many talented executives with this approach - the “Killer Dillers” (side note, “Diller’s Killers” was right there🤦) include Jefferey Katzenberg (Dreamworks … and Quibi RIP), Michael Eisner (Disney), Dara Khosrowshahi (Uber), Strauss Zelnick (Take Two / CBS). The story of Diller mafia member Anjali Sud (Vimeo) synthesizes the method:

[Anjali Sud is] a great example of that. I was running Vimeo on an interim basis for close to a year. The company divided into two pieces. One was Anjali’s side, tools for video creators, and the other was using the Vimeo platform to be a destination where we were creating our own content for audiences. At some point, she said to me, “I can make this business much bigger under the strategy that I’m learning.” And I said, “Great, do it.” And she did. We scrapped [the content creation] and moved everybody onto the other when we promoted Anjali to CEO.

Source: Wharton (🤮) Magazine

The sink-or-swim approach to management and development is one that resonates with me - it’s the kind of system I feel most comfortable in and the type of system I’m most comfortable deploying. Thus, I find it sort of inspiring to see the cadre of talented operators who were forged through Diller’s system.

Also, Diller’s “Little Island” off the WSH in Manhattan is easily a top 5 billionaire pet project.

Jamie Dimon

Fascinating because: Dimon is the ultimate statesman CEO whose scope as an executive is unparalleled.

“This country is a lot better off because Jamie Dimon has been running JP Morgan.” - Warren Buffet

The reach of JP Morgan Chase is absurd. It banks consumers and small businesses. It banks multinational corporations and nation states. It has >300,000 employees. And all of that breadth is under the purview of Jamie Dimon.

Dimon commands this veritable empire with extreme charisma. In many ways, his role at the helm of JPM is to be this grand statesman across the myriad counterparties of the firm. In this role, he has a track record of deftly navigating ultra high-stakes flashpoints. Basically at gunpoint he led the buyout of WaMu and Bear Stearns in ‘08 and then orchestrated the rescue of First Republic in 2023. His muted commentary on the 2024 election is an example of the measured statesmanship required to navigate uncertain political waters. For all the criticism of wanting his cake and eating it too, his stance on crypto is also a great example of this:

Dimon has remained a fiercely outspoken bitcoin and crypto critic even as Wall Street began to warm up the technology, calling it a "fraud" and a "Ponzi scheme" in April. Dimon has said that if he was in government, he'd "shut it down," and branded bitcoin a "waste of time," calling it a "pet rock" that "does nothing."

However, Dimon has led JPMorgan in developing and deploying its own blockchain and cryptocurrency, JPM coin, to speed up and reduce the cost of transactions.

Source: Forbes

His statesmanship provides a great model to learn from. Bill Ackman said it best - Dimon for President baby.

Michael Ovitz

Fascinating because: Ovitz’s work is a masterclass in tactical execution, winning the key moments “in the trenches” that compound to build success.

There are so many fascinating Michael Ovitz anecdotes that highlight why I think he is such an expert tactician. I just finished his memoir “Who is Michael Ovitz” which is full of situations where Ovitz and his team at CAA had a one-shot opportunity to dazzle a new client. They all have this common theme - wherein Ovitz hyper-analyzes how to win a single pitch that moves his business a step further.

One of my favorite anecdotes that encapsulates this approach to winning every moment is when Ovitz and CAA pitched for the Coca-Cola advertising business against its longstanding partner McCann Erickson:

We put together a team of in-house experts in movies, television, music, and books and we combed every Coca-Cola print ad and commercial since McCann Erickson got the account in 1955. Two weeks later we met in Atlanta with ten division heads, and then we broke into small groups for no-holds-barred discussion. The meetings lasted twelve hours, the best one-day education I ever had.

Source: Who is Michael Ovitz

Michael: [Coca-Cola] said, will you come do what's called a shootout? A shootout is where you come in and all the ad agencies pitch to the executives….

They set the date... for 11:00 AM on a weekday, and I flew our team of five people in the night before. We checked out the room we were going to do it in. We rehearsed what we were going to pitch, and we went for a very nice dinner. I bought everybody new Armani clothes and we got up the next morning. I'll never forget this. We went to the gym. We had a nice breakfast, we walked in at a quarter to 11:00, sat down, and we looked the part.

Ben: One would say it's a show of strength.

Michael: At 5 to 11:00 AM, the McCann people, there were 35 of them, drifted in having just gotten off a 6:00 AM flight from New York. I'll tell you they looked like they were all in a blender. They kind of looked like live smoothies. They were wrinkled, ratty, and all screwed up, and nice people too, but whoever sent them to fly in the morning made a critical error.

Anyway, they flipped a coin and they said they won. We were hopeful that… they'd go second because we wanted to go first and blow their doors off, and we did… We went in and we presented 35 ideas and we acted them all out. Each one ran for 30 seconds. We did it crisp and clean with music, with expression, with enthusiasm.

… We had these guys. I will never forget, I was sitting next to Bill Haber but next to me was John Dooner from McCann-Erickson and then a guy who had been friends with Don Keele for 35 years… This guy wrote Dooner a note. I saw it by accident and it said, we're screwed.

Sure enough, we finished, and then they came up. They were so bad that after seven or eight minutes of presentation, they sat down. We got awarded the account. Of the 35 commercials we presented, they approved every single one.

Source: Acquired Podcast

A recurring theme I see in exceptional commercial teams at early stage companies is that they treat every pitch like it is the Superbowl with a clear goal of how they want to make the customer feel. I’m not sure there is a better example of someone building a business brick-by-brick, client-by-client with that approach than Michael Ovitz.