What a crazy year it’s been. Wherever you are, I’m wishing you all the best of luck as you take on your new-year-new-me resolutions.

Stuff I’ve been thinking about:

Grading my 2021 picks

Brief predictions for 2022

Stuff I liked lately:

🧸 Beanie Mania (HBO Max) - Perfect late stage bubble viewing. Had no idea that the Chicago burbs were the epicenter of the beanie bonanza

✏️ America’s Gambling Addiction is Metastasizing - This really resonated with me and elucidated the ramifications of the “financialization” of everything (@ web3 hardos)

“…the righteousness or unrighteousness of any economic activity is no longer a question that anybody demands answers to, or even ponders much. Transactions once considered the purview of the Mafia have been mainstreamed—credit lines with 23 percent APR, extreme pornography, and legalized gambling all available from a device in your pocket.”

✏️ GMO 3Q21 Quarterly Letter - compelling analysis of the composition of US stock market returns in the 2010's vs. the 2000’s with a really interesting takeaway:

Multiple expansion of nearly 10% a year for 10 years resulted in valuations more than doubling. For example, the index increased from a multiple of 17x 10-year average real earnings on September 30, 2011 to 37x on September 30, 2021. Why is the market now willing to pay such higher multiples for U.S. companies when the companies themselves look to be delivering fundamental returns that are more or less the same as they delivered in the prior decade? Lower interest rates are a natural culprit, although if low interest rates were the sole driver of high equity market valuations, one would expect to see much higher valuations in Europe and Japan. The argument for high U.S. valuations tends to come down to a belief that American companies are special – the only winners in a world of losers.

Is that a basis for a continued valuation premium for US equities? Hmm…

Acquired Podcast - CAA (with Michael Ovitz) - just a cool/fun listen with some inside baseball about Hollywood

🔮 Vickstradamus 🔮

As we embark on a new year, I thought it would be appropriate to hold myself accountable for my predictions for 2021. This time last year, I predicted that in 2021 we would see the following trends:

Adoption of next generation elder-care technology (e.g. remote patient monitoring) expands as millennials re-think caring for their parents

Grade: C-

There was progress against this theme in 2021. For example, CMS loosened requirements for remote patient monitoring codes (e.g. in COVID effected skilled nursing facilities, providers could bill for RPM services with just 2 vital readings in a month vs. the typical 16 readings in a month). Loosening restrictions enabled greater experimentation and adoption of these types of technologies. There’s also continued progress being made in the world of digital biomarkers and measurement devices (e.g. greater adoption of connected glucose monitors, advancements in patient reported outcomes measures for use in decentralized clinical trials). Still, we are a long way from having connected health devices monitoring everyone’s grandparents.

Big pharma’s role as the world’s COVID-19 savior creates tailwinds downstream for pharma tech/services companies

Grade: B-

American consumers effectively subsidize biotechnology innovation by paying the highest drug prices in the world, enabling pharma companies to earn returns on their R&D investments (which would be substantially lower if American drug prices were at parity with prices paid in other markets). The reward for the pain of high drug prices is the long term, post-patent expiration benefits of biomedical innovation (e.g. solving rare diseases that otherwise don’t make economic sense to tackle) and having a robust apparatus in place to rapidly drive that biomedical innovation (i.e. people who are trained in doing good science at scale). In this instance, the spoils came in the form of rapid, nearly ubiquitous access to vaccines within months. Still, in December President Biden made some strong claims against the industry with a promise to drive lower prescription drug prices (e.g. by capping price increases on generics, enabling Medicare to negotiate drug prices). How serious he is about this in the face of major triumph from the industry over the past couple of years will determine how real the “savior tailwinds” are. Given his track record against his own promises YTD (RIP free college), I’m skeptical of his resolve here.

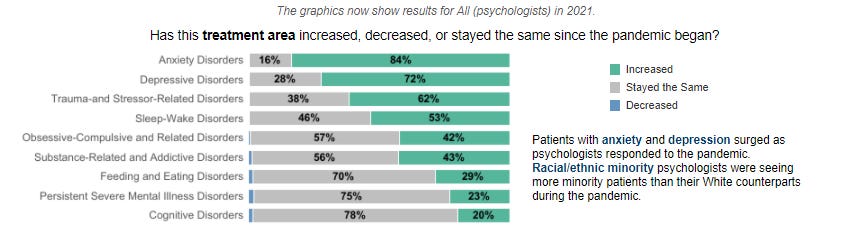

Psychiatric care demand explodes as the country emerges from a “Long Winter”

Grade: A

Demand for psychiatric care has absolutely exploded this year. Just look at this data below from the American Psychology Association which illustrates that demand for treatment of virtually all psych-related disorders has significantly increased since the onset of the pandemic. As mental health startups raise billions of dollars to try and fill this demand, the key pain point they will need to solve is scalably building clinician supply. I expect that the companies that will be most successful will be ones that are able to meet both the patient and the clinician where they are via a hybrid telemedicine/in-person approach like Mindful Care, one of our recent investments at Sopris Capital.

US faces a massive resurgence of the opioid crisis

Grade: A

Another trend it’s hard to feel good about being right on - opioid abuse has significantly expanded over the course of the past year, driven by pandemic-related issues like delayed surgeries but also the extrinsic pressure of a massive surge in fentanyl in street-drug supply. The dashboard below from the CDC speaks volumes.

Overall - not too shabby. Better than my actual college GPA.

Feeling ‘22

As for 2022, here some quick predictions I’d like to visit in-depth later:

💊 A mix of seasonal boosters, anti-viral pills and fatigue pushes us on from COVID-driven stasis this year (see also, 2022 is the real “hot vax summer”)

📈 Significant continued inflation

Many people are suggesting that inflation is now priced in and even mitigated by wage increases but I don’t think that’s true for two reasons:

Inflation is going to significantly exceed wage gains - e.g. food prices have already increased a lot in 2H 2021 and are positioned to increase an additional 2-20% in January alone whereas most wage increases won’t keep pace (e.g. federal employees are set to receive a modest 3% wage increase on average)

Healthcare costs should rise sharply next year as hospitals/health-systems contend with pandemic burnout compounding already constrained workforces, just as they look to ramp up traditional service volumes (e.g. delayed elective surgeries) in a post-COVID world

Second order effect - if Republicans can shift the focus from their weirdo conspiracist delegation, the pain felt on Main Street from higher prices at the grocery store should deliver a shellacking to Democrats this election year

👨⚕️ Risk adjustment becomes a paramount concern for value based care organizations

In a nutshell, value based care is has the following formula - I, the payor (maybe it’s the government or a commercial insurance company), will pay you, the value based care provider, $100 to manage Patient X’s care; you have to spend at least $80 on their care, but you can keep every dollar after that if you don’t spend it (i.e. if you only spend $90, you just earned $10 in profit)

One way to make money is to spend less on care, usually by addressing upstream healthcare issues (e.g. getting Patient X into their primary care doctor’s office once a quarter) and avoiding hospital visits for Patient X

However, another way for you to make more money is to convince me to give you a higher payment to care for Patient X. You might say to me, well, Patient X suffers from diabetes, hypertension and obesity, so it’s actually more expensive to take care of them; I might look at that and say, OK, you can have $125 to take care of Patient X

I think cost/utilization forecasting for patient pools could be difficult this year because we’ve had two years of very abnormal healthcare services consumption (e.g. people putting off surgeries because their local hospital was overwhelmed by COVID). If you just looked at claims data for a patient population that was avoiding healthcare services due to COVID, they would look less costly to care for than they really are

As a result, value based care organizations will likely look to mine patient data to find additional risk adjustment factors that will enable them to increase revenue per patient. To do this, the value-based care group needs to find diagnoses that might be missed in the structured data they have on a patient; they might deploy an NLP software to parse unstructured data (like doctor’s notes from a patient visit) to identify additional risks for Patient X which can increase their base rate of compensation.

📱 Telemedicine takes a step back as normalcy returns

Something like 53% of patients prefer in-person visits and as healthcare providers seek to meet patients where they are, a lot of volume will probably return to in-person care. This is most relevant where telemedicine providers do not have a captive patient population. Note, this is not at all an “L” for telemedicine companies; people thought it could take 10+ years for this level of telemedicine adoption. The acceleration of telemedicine usage by the pandemic is nothing short of remarkable

An outside concern to watch this year is the emergence of fraud, waste and abuse issues in telehealth. Over the past two years, providers raced to implement virtual care. It’s almost certain that either because of malicious intent or neglect, there were some telemedicine activities conducted by these providers that did not have the adequate level of documentation/support for the level of service that was billed to payors

📉 Massive correction in highly speculative investments

Tangentially, I expect that crypto exuberance will cool next year as a killer app remains elusive (similar to “AI-winters” of the past). Centralized systems work pretty well, despite the claims of people who feel like getting de-platformed by Twitter is a hate crime, and the solution for their shortcomings is probably reform, not wholesale reconstruction of a new internet lol