Healthcare's Labor Challenges are Here to Stay

The era of chronic undersupply dawns. What does it mean for stakeholders?

Staffing shortages have erupted into a five-alarm fire complicating operations for care delivery and services organizations in every corner of the healthcare ecosystem.

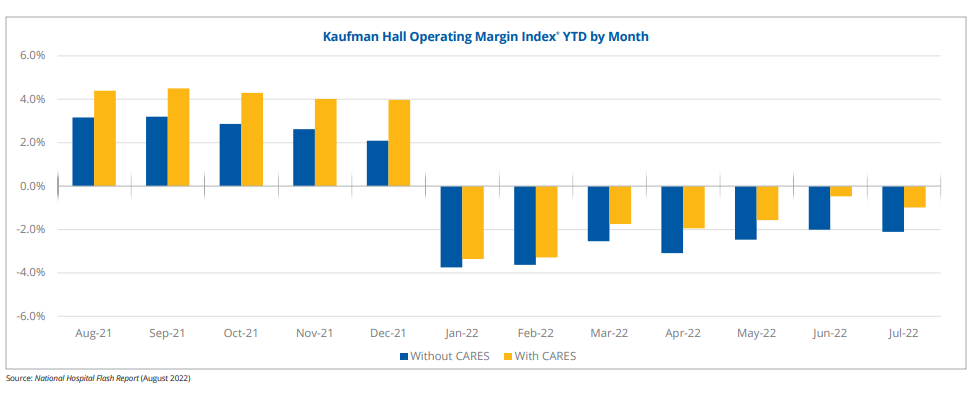

The business impact of staffing shortages is severe. Hospitals and health systems have experienced significant margin contraction due to outsized short-term contract labor spend (e.g. travel nurses). Care delivery companies from behavioral health to skilled nursing are struggling to meet demand because of persistent personnel turnover. Digital health companies that sell their offerings into health systems are experiencing protracted sales cycles because their customers’ singular near term priority is the resolution of their own staffing problems.

Staffing shortages are a pull-forward, not a blip

The optimistic view is that acute staffing shortages are a one-off COVID-driven supply shock. Over time as the pandemic subsides, labor supply should normalize back to pre-pandemic levels, easing the cost burden on operators. There’s some evidence to support this view; for example, leading hospital operator HCA reported on its most recent earnings call that peak contract labor utilization is squarely in the rear-view mirror, implying that the worst of labor cost inflation should be behind the industry.

However, there’s also a lot of reason to believe that labor cost inflation is not going anywhere.

Rather than characterizing labor shortages as a one-time shock, it’s more accurate to view this as a “pull-forward” of supply shortages that were going to impact the market in the future based on prevailing supply/demand trends. That is, just as it pulled forward demand for lots of things (e.g. telehealth, e-commerce, WFH), the pandemic simply pulled forward declines in clinical labor supply that would have been realized over several years.

Projections have long indicated that rapidly rising demand for clinical services would soon (i.e. in like 10-15 years) outstrip clinician supply. Consider the supply of registered nurses. Growth projections for the supply of registered nurses were already tepid pre-pandemic. The pandemic has effectively pulled forward several years of RN exodus. Thus, critical levels of supply/demand imbalance are materially closer than pre-pandemic projections.

It’s hard to see how this trend reverses over the near to medium term.

One reason for that is that supply shortages create a negative feedback loop. With fewer available staff, remaining staff has an even higher workload burden, driving more burnout and more turnover. Insufficient staffing is the most commonly reported reason for clinical staff quitting. Just this week, 15,000+ nurses in Minnesota staged a walk-out in protest of insufficient staffing levels across area health systems. A recent survey quantifies the sentiments on the picket line, suggesting that the risk of nurses dropping out of the workforce is at an all time high:

Nearly one-third (28 percent) of nurses indicated their desire to leave the profession had increased dramatically since the pandemic, while those who said their desire to stay had increased since the pandemic dropped from 24 percent last year to 4 percent this year.

Source: Florida Atlantic University & Cross Country Healthcare Joint Survey, Sept 2022

Further enhancing the pricing power of clinicians is the unprecedented flexibility that clinicians of all levels have today to choose how and where they want to work. For example, physicians and mid-level providers of all specialties can pick up part-time or full-time work via a plethora of telemedicine platforms in the market. This is particularly appealing to physicians who might be burned out in their current setting of care (which is like, >half of physicians!).

All of this means that healthcare services companies need to think very hard about the value proposition they offer to clinicians.

In startupland, it can be hard to see the impact of this problem when looking at a care delivery company that is onboarding a few clinicians per month; but as a company scales and starts to add 10-15+ clinicians per month, ensuring that the right infrastructure is in place is critical to recruiting & retaining valuable clinical talent and driving commercial momentum.

Your margin compression is my tailwind

Ultimately, there are several stakeholders that are well positioned to enhance their market power in the face of prolonged staffing shortages over the medium term. Some of these are:

CMOs & Clinical Leaders at Early Stage Companies

Elevating clinical leadership to the helm of the organization is critical for any healthcare startup that wants to survive the long haul. Sustainable business models need to be rooted in good medicine. And in order to achieve that, clinical leadership should be able to have direct input into the business model at all stages of development.

The absence of clinical input into areas like bizops and product yields situations where business outcomes completely skew the workflows of front-line clinicians in ways that can actually be harmful to patients. A perfect example of that dynamic run rampant is D2C telepsychiatry companies like Done and Cerebral effectively running online Adderall pill mills in support of hypergrowth aspirations. From D2C to DEA!!

Clinical leaders can help establish clinical protocols and assist with designing key business levers like provider utilization, onboarding and ongoing training. Strong clinical leaders can also help inspire confidence in prospective clinical hires, providing a competitive advantage with respect to recruiting. As a result, demonstrated clinical leaders will be coveted more than ever by high-growth healthcare startups.

Contract and Shift-Based Staffing Tech Platforms

If the monster growth rates posted by public healthcare staffing firms in the past several quarters is any indication, increasing complexity for clinician recruitment and retention will significantly expand the pie for firms in the healthcare staffing value chain.

A litany of digital marketplaces and enterprise software applications have emerged to support the gig-ification of healthcare labor. Companies like ShiftMed, CareRev, TrustedHealth and Incredible Health help healthcare workers match with on-demand or contract labor opportunities. On the flip side, a multitude of next-generation vendor management software platforms and tech-enabled managed service providers are seeking to digitize the management of contingent labor on the back-end for health systems. Although at some point it’s natural to expect consolidation with so many players in this fragmented space, there is so much room for continued digitization of staffing workflows that there will likely be sufficient whitespace to accommodate multiple winners in these categories.

Rentable Provider Networks (AWS for Healthcare)

If you can’t build it - rent it! As provider recruitment and retention becomes more complex and costly, it will become less compelling for care delivery companies to build their own networks in-house. This is compounded by the fact that in a rising interest rate environment, capital is more expensive and upfront investments into fixed costs (like a W-2 provider network) are harder to economically justify.

Instead, digital health companies can look to rent provider networks for a multitude of enterprise telemedicine use cases (e.g. tele-consults, data annotation) from companies like Medcase*, Wheel and SteadyMD. Companies that need clinical capacity but don’t have the bandwidth or in-house core competency to manage the tremendous complexities involved with physician recruitment, credentialing and retention can leverage these on-demand provider networks to support their business models, enabling them to narrow their focus on what makes their “beer taste better”.

Upskilled Non-Clinical Labor

One idea that could help relieve pressure on constrained labor supplies is upskilling existing parts of the non-clinical labor pool. For example, life coaches could be trained and certified (=/= licensed) to provide basic cognitive behavior therapy, greatly expanding access to therapy for patients. Non-clinical resources could be cost-effectively deployed in patient’s homes to perform data gathering activities or serve as a conduit to care (think a non-clinical person brings a tablet to a patient’s home so that they can tele-interface with a physician); Atlanta-based HealPros* leverages a similar model to solve major pain points for health plans. While there will always be a need for expert licensed physicians and mid-level providers to make clinical decisions, upskilling the labor pool can help patients get more cost-effective care while providing more people with a compelling career track in healthcare.

Physician Workflow Automation Tools

The biggest driver of physician burnout is administrative burden. It’s kind of funny that while physician time is more valuable than ever, physicians are spending inordinate amounts of time dealing with bureaucratic tasks.

This is a broad category with many interesting ideas/companies percolating. Some cool ideas out there now: AvoMD enables physicians to build automated workflows that can be deployed at the point-of-care. HealthNote is automating the patient intake process. Abridge’s AI platform transcribes and structures patient/physician interactions to streamline charting, notes and claims. Azra AI* screens unstructured patient data to flag and surface patients at risk of developing cancer.

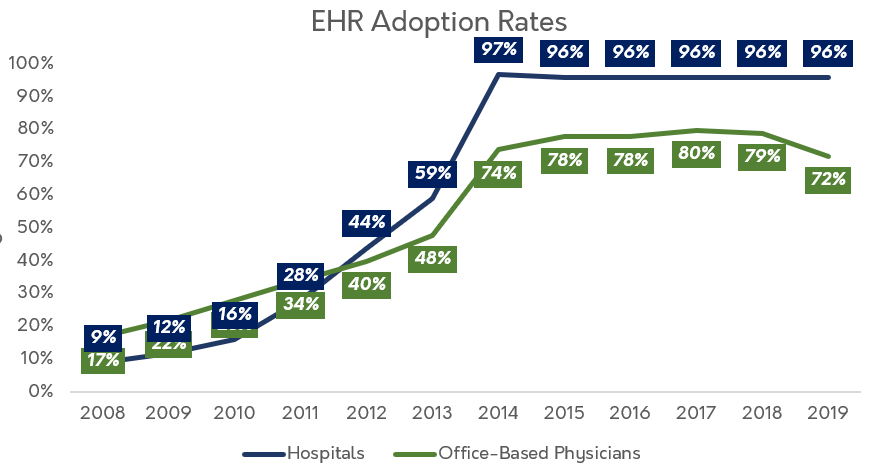

There are so many ways that digital health companies can solve the major pain points of bureaucracy and capture huge market value. A caveat to this optimism is that given the glacial pace of healthcare innovation, these technologies will likely take a long time to achieve widespread adoption. Just consider how long it took to achieve widespread EHR adoption even with the help of regulatory mandates.

Still, marginal gains in this area can unlock significant value.

If you build it…

Healthcare’s labor problems are not going anywhere - companies that can build a durable advantage in provider/physician recruitment and retention, or help other healthcare stakeholders in this area, are well positioned for the coming storm ⛈️.

*denotes a Sopris Capital portfolio company. It’s called full disclosure people!