Don't Sleep on Brick-and-Mortar Care

Brick-and-mortar clinics have durable moats against telemedicine disruption

In the past year and a half, telemedicine volume and the number of virtual-first health companies have exploded.

One of the key value propositions of taking healthcare virtual is the expansion of clinician supply from what’s available locally to a distributed, national supply of providers. This unlocks access to clinicians in areas that are starved of clinical talent. I like this bit from Julie Yoo at Andreesen Horowitz:

Thanks to new regulation that eliminates geographic boundaries as a barrier to accessing untapped supply across our healthcare system, we can now think about capacity at national scale versus merely at a local level.

Behavioral health is a great example. 55% of counties across the US do not have a practicing psychiatrist and >75% of counties are categorized as having “severe shortages,” with the problem significantly more acute in rural areas.

Percent of State’s Mental Healthcare Need Met by Psychiatrist Supply (via KFF):

Source: Kaiser Family Foundation (data as of Sept 2020)

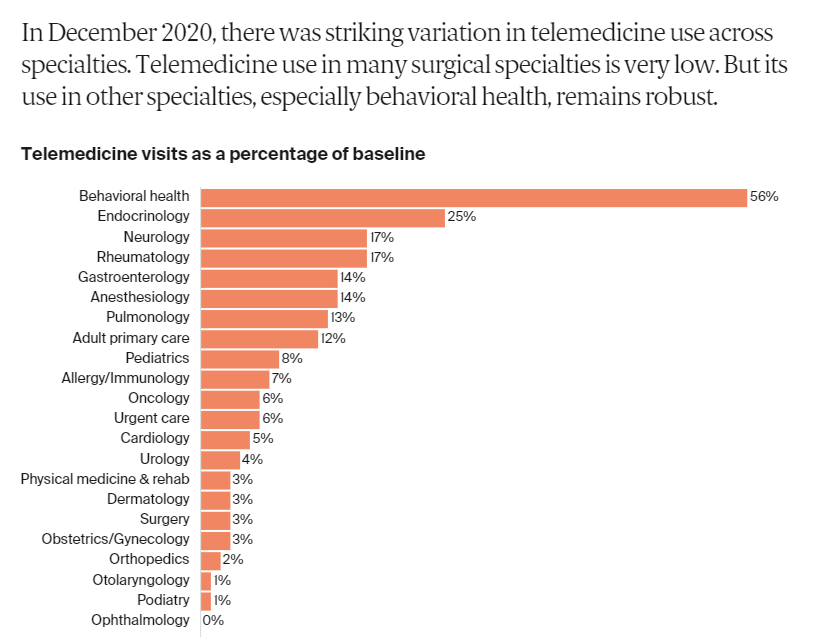

With a virtual-first platform, you can find clinicians where they are and have them deliver care to patients who otherwise would have to travel hours to the nearest psychiatrist. Where patients can’t find clinicians, you can bring the clinician to the patient. Interestingly, behavioral healthcare appears to have achieved the greatest rate of telemedicine penetration among sub-specialties:

Source: Commonwealth Fund

However, a direct consequence of being able to bring the clinician to the patient is that we can also expand access to patients for clinicians. This drives more competition for patients.

If a clinician can deliver care to any patient in the states where he or she is credentialed/licensed (regulation permitting), the TAM of patients is significantly expanded. In the past, a physician might have had a captive panel of patients just based on where the patients were located. Suddenly all of that physician’s previously captive patient population can be targeted by tele-enabled competitors. This is an added benefit for patients because their providers’ relative pricing power is significantly undermined by this trend.

Able to attack a broader pool of patients, telemedicine companies are investing significant resources into digital marketing as a patient acquisition engine. The uptick in ad spend is similar to what we saw from digitally-native consumer brands during the “Casper for XYZ” gold-rush. An influx of highly capitalized firms in highly competitive markets deploying massive budgets into ad spend tends to drive meaningful CAC inflation, which can kill companies that can’t commensurately scale customer LTV.

In contrast to telemedicine companies that drive capital into ad-based customer acquisition engines, brick-and-mortar clinics have a highly-effective, built-in customer acquisition engine: foot traffic.

Carbon Health dropped a crazy stat that 95% of its visits are driven by walk-by’s and word-of-mouth. Rent is the new CAC! Which is funny because with the advent of innovative, small-footprint models (e.g. locating medical practices in co-working spaces), combined with recent pressures on commercial real estate, rents are lower than ever, compressing overhead and driving even better economics at the unit level.

Another benefit that brick-and-mortar healthcare businesses have is on the organic search side. Searching for “xyz doctor near me” is another cost-effective engine for patient acquisition that telemedicine providers can’t easily replicate.

Further, creating a physical footprint creates a platform through which companies can create referral networks with other local providers; Lifestance Health, a leading clinic-based outpatient behavioral health company, reports that >90% of its visits come from GP referrals.

A counter-argument might be that digital first companies can target such a big pool of potential customers that they should be able to dwarf the output of brick-and-mortar providers. This points to a key difference between healthcare and the consumer brands example from above: healthcare services have rapidly diminishing marginal returns from finding new customers. This is because output is rate-limited by clinician capacity. You could find a million new patients, but your physicians only have 8 hours a day to see/treat patients (and probably less if they have admin work on top of that).

For most healthcare services, there is tremendous unmet demand and not enough supply because of the widespread, growing shortages of clinicians across specialties. Successful companies - both virtual-first and brick-and-mortar - will need strong clinician recruitment and retention capabilities more than they need demand-generation capabilities.

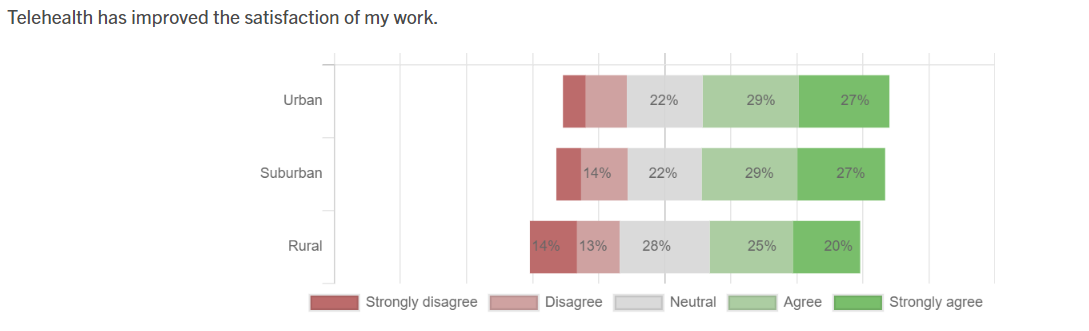

To this end, you could argue that telemedicine companies have an advantage because as mentioned above, they can recruit from a much wider pool of clinicians. However, they might struggle to provide an undifferentiated value proposition to clinician. Each telemedicine application is not that different than any other, and all telemedicine companies will offer the same core value proposition to clinicians of “working from home” and automating some of the admin/back-end. On the other hand, it’s possible that brick-and-mortar clinics might be able to build a brand and experience for clinicians that does create a differentiated retention advantage. For example, for clinicians that prefer to work in person (which appears to be a a decent proportion per the survey below), the ability to work out of a sleek office with a strong brand/reputation might be very compelling.

Physician Survey on Satisfaction Using Telehealth (via Covid-19 Healthcare Coalition):

These patient acquisition and potential clinician retention advantages should serve to help create a durable moat for brick-and-mortar healthcare services companies.

But if we take it a step further: an obvious conclusion is that a best-of-both-worlds hybrid approach - where you can expand clinician supply via telemedicine while benefitting from the captive demand of local foot-traffic, particularly in hard-to reach areas like Rural America - would be really interesting.

Here Comes the General

What company out there has massive footprint of brick-and-mortar locations that generate a lot of foot-traffic in towns across the USA, with a strong presence in rural areas? Here’s a hint - they just hired a Chief Medical Officer.

Dollar General is a fascinating company and its rise/continued momentum is a really interesting study into economic and cultural shifts that have taken place across the country (great coverage on this from ProPublica, NPR, WSJ).

The Company’s current store footprint exceeds 17,000 locations, which is almost 4x that of Walmart, while continuing to open thousands of new stores per year. This results in Dollar General stores being 10-15 minutes away for many small-town residents vs. Walmart/other retailers being 30+ minutes away. This is a tremendous advantage for the Company’s core retail business, but it also creates a really unique platform for delivery of healthcare services.

Imagine if over time, Dollar General could roll out a small-footprint in-store mini-clinic in each of its locations which would enable customers to walk-in for tele-visits with physicians. Those visits also benefit the Company by driving repeat visits and greater spend in stores, particularly if stores start to stock more healthcare related products. As the shift to value-based care continues and rural managed care gains steam (illustrated by the recent launches of groups like Main Street Health), a company like Dollar General could be well positioned to serve as a conduit to care for its effectively captive, clinician-starved customer base.

I recognize that it sounds a bit absurd. Even if it was feasible, it would take a looong time to reconfigure thousands of stores to accommodate even mini-clinic space, let alone figuring out the right technology stack/staffing/operational plan. Still, opening 1,000+ stores a year offers ample room for A/B testing these inputs.

Ultimately, there is a credible case that with decent execution, 15 years from now we could really be looking at a world where Dollar General is the nation’s leading healthcare provider.

In the meantime - and particularly in more densely populated areas - brick-and-mortar clinics will continue to have sustainable advantages against virtual-only peers, which should strengthen as competition in the telemedicine space increases.

//