I’m taking the arrival of the new year as an opportunity to ruminate on what’s coming ahead in 2021. Here are some healthcare-related trends that I’ll be watching.

2021 Predictions:

Adoption of next generation elder-care technology (e.g. remote patient monitoring) expands as millennials re-think caring for their parents

Big pharma’s role as the world’s COVID-19 savior creates tailwinds downstream for pharma tech/services companies

Psychiatric care demand explodes as the country emerges from a “Long Winter”

US faces a massive resurgence of the opioid crisis

I explore each of the predictions in further detail below.

Drop me a line if you think I’ve got it right/wrong.

//

Adoption of next generation elder-care technology (e.g. remote patient monitoring) expands as millennials re-think caring for their parents

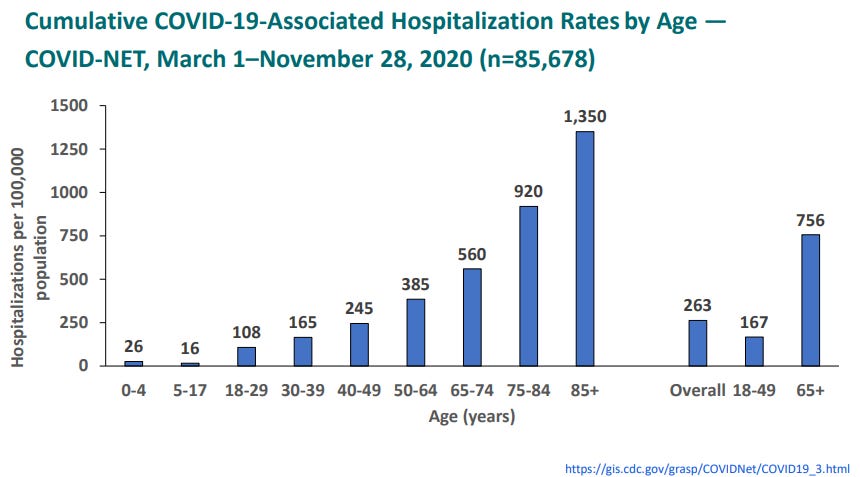

COVID-19’s disproportionate impact on the elderly will leave a searing burn in the minds of younger generations.

Source: CDC Presentation, December 2020

In addition to navigating pandemic-driven changes in their own lives, younger adults were directly forced to consider the topic of how best to care for their higher-risk parents. The topic is especially prominent for the 39% of millennials who reported moving back home with their parents due to COVID-related financial duress. Per USA Today:

Some millennials are caring for parents who contracted COVID-19, while others are doing their grocery shopping and running other errands to ensure they remain COVID-free, Beligotti says. Those responsibilities are likely to continue even after a vaccine is available, presumably next year, and the outbreak has faded. Ninety percent of the adults surveyed expect to provide financial, housing or caregiving support beyond the pandemic.

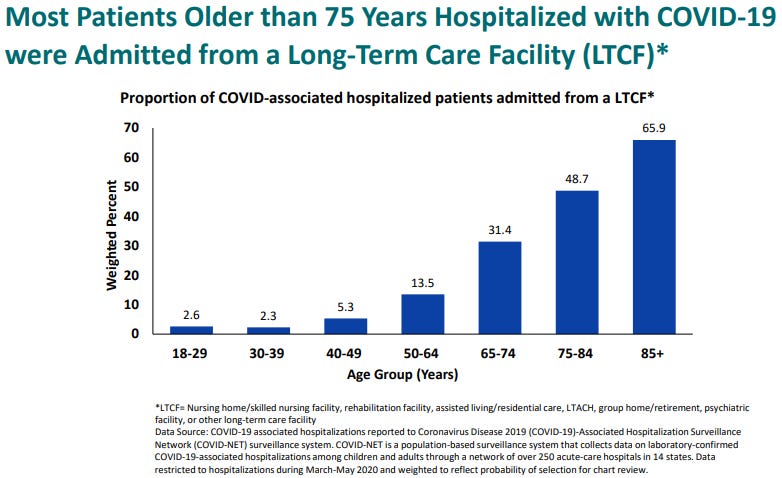

Further, where older adults choose to age will change. While aversion to nursing homes is not new (see this 1997 survey in which 30% of respondents said they would rather die than move to a nursing home), it will be exacerbated by the disastrous COVID outbreaks that appeared in long-term care facilities nationwide throughout 2020.

This is well summarized in a post by the AARP:

Whatever this wretched plague was, nursing homes would soon bear the brunt of its impact. By the fourth week in June, at least 54,000 residents and workers had died from the coronavirus in nursing homes and other long-term care facilities in the United States. Nearly 264,000 people were infected across 9,912 facilities.

One statistic stands out: Residents of long-term care facilities constitute less than 1 percent of the U.S. population, yet 43 percent of all COVID-19 deaths through June occurred in those places. The number has changed little since.

For the residents, nursing assistants, doctors, families, administrators, public officials and “last responders” on the front lines, numbers alone cannot capture the terror, frustration, exhaustion and occasional miracle story that occurred during the early months of the crisis…

But make no mistake: COVID-19 wasn’t vanquished from nursing homes in June. By Thanksgiving, the death toll in America’s long-term care facilities had surpassed 100,000, and each and every site is still grappling at this very moment with providing safety and care to its residents and workers as the pandemic continues unabated.

Source: CDC Presentation, December 2020

In light of this tragic data, more families will elect to have older members age in-place at home vs. a long-term care facility (as an aside, this is also a clear tailwind for home-health companies). More aging at-home means that younger adults will shoulder a greater burden in managing their parents’ care.

This is a tech-savvy generation that will look to novel technologies to help ease this burden. As a result, consumer adoption of remote patient monitoring technologies (e.g. connected devices/wearables) will expand rapidly.

The trend of younger adults taking ownership over their parents’ healthcare has legs beyond 2021, as documented by Gal Wettstein and Alice Zulkarnain for the Center for Retirement Research at Boston College:

The caregiving issue is becoming increasingly important. In the coming decade, baby boomers will begin reaching their 80s, an age when the need for care rises substantially. This cohort is larger than earlier generations, but also had fewer children per household. The resulting higher ratio of parents to children suggests a potentially bigger burden for the boomers’ children than for previous generations.

I predict that COVID will be a catalyst for increased consumer remote monitoring adoption in 2021, which will persist (and accelerate) over the coming 5-10 years.

Big pharma’s role as the world’s COVID-19 savior creates tailwinds downstream for pharma tech/services companies

For months, all eyes were on global pharma companies to deliver a vaccine that could alleviate the anguish of the pandemic. An excerpt from a December article in Quartz illustrates the pivot in public opinion on the sector because of its successful efforts to develop a vaccine for a novel virus in <10 months:

About a year ago, there was no business sector as disliked in the US as the pharmaceutical industry.

According to a yearly Gallup survey conducted in September 2019, 58% of Americans held a negative view of the sector. Only the federal government, disliked by 52% of those interviewed, was anywhere close. This was the worst perception of the pharma industry ever recorded since the annual survey was introduced in 2001.

At the time, Gallup suggested there were two causes of such public antagonism to pharmaceutical companies—their role in the opioid crisis, and high drug prices. Addressing those issues, the firm said, would be key to building back any lost reputation.

But when the same survey was administered this September, the results were quite different. The percentage of responders with negative views of pharmaceutical companies fell to 49%, and 34% expressed a positive view, up from 27% in 2019.

It could hardly be otherwise—if the world is going to make it out of the Covid-19 pandemic that has stolen 2020, it’s going to be because of the work of pharmaceutical companies. Approval of drugmakers has likely gone up throughout the rest of the world, too, and even more so since the announcement of the first successful vaccine candidates in November…

… For an industry that invests enormously in marketing—in the US, more than on research and development—Covid-19 vaccines have provided a unique opportunity. According to brand reputation specialist firm Caliber, which publishes a yearly Global Pharma Study tracking public perception of pharmaceutical companies in 17 countries, Covid-19 is reminding the world why we need drugmakers.

The spotlight on pharmaceutical and biotech companies during the pandemic likely diminishes the persistent, lingering (albeit low-probability) risk of any major price control action by regulators over the near term.

As a result, I would expect pharma/biotech valuations to expand, which should also benefit pharma tech/services companies downstream.

Psychiatric care demand explodes as the country emerges from a “Long Winter”

The pandemic accelerated the ongoing mental health care crisis in the US. From National Geographic:

…clinically significant mental health issues associated with the pandemic are on the rise. More than 40 percent of U.S. residents have experienced mental or behavioral concerns such as anxiety, depression, suicidal thoughts, and increased drug or alcohol dependence since March—almost double the prevalence of mental health concerns from previous years, as shown by an August report from the Centers for Disease Control and Prevention. Among the most affected have been young adults, people from minority and lower socioeconomic backgrounds, unpaid caregivers, frontline workers, and people with previous mental health diagnoses. Respondents from these groups also reported using drugs and alcohol to cope more frequently than other groups, exacerbating the issues.

Also, from a study published by researchers at Johns Hopkins:

In this population-representative survey study of US adults, we found that prevalence of depression symptoms was more than 3-fold higher during COVID-19 compared with the most recent population-based estimates of mental health in the US. This increase in depression symptom prevalence is higher than that recorded after previous mass traumatic events, likely reflecting the far more pervasive influence of COVID-19 and its social and economic consequences than other, previously studied mass traumatic event… These results suggest that context matters, and that the combined context of the COVID-19 pandemic and its economic consequences have resulted in an increase in mental illness in US adults.

Psychiatric care is already severely supply constrained, and the pandemic has pushed the population further along the psychiatric severity curve.

The increased demand for clinical psychiatric care creates strong tailwinds for operators of behavioral health care companies - including operators of clinic-based models and telepsychiatry focused companies.

In addition, given the strong link between behavioral health care issues and increased overall healthcare spend, payors will be meaningfully incentivized to better identify and steer care for patients in their coverage pool who need psychiatric treatment. This is a tailwind for companies that can leverage analytics to identify behavioral healthcare issues in patient populations like Tridiuum.

US faces a massive resurgence of the opioid crisis

Quietly lurking beneath the incessant coverage of COVID-19 is another “second wave” that is likely to have devastating impacts nationwide - a resurgence of opioid abuse.

The connection between economic despair and opioid abuse is explored by Carol Graham in a paper for the Brookings Institution:

Since the 1970s, the decline in manufacturing has hit specific regions and communities much more than others. Mortality, for example, is higher in places with industries where Chinese competition increased most intensely (Pierce and Schott, 2016). More generally, it reflects an increasing trend of automation replacing low-skill jobs. The same communities that saw pronounced declines in employment also experienced decreases in marriage rates, increases in the percentage of prime aged-males out of the labor market, reliance on disability, and the per capita consumption of opioids (Krueger, 2017). The latter two trends relate in part to the toll that manufacturing and mining jobs take on workers’ health. Related to this, while union jobs—which are fast disappearing—tended to come with stable health insurance, reliance on disability insurance for health care creates perverse incentives as re-entering the labor force requires forgoing disability benefits. Higher levels of reported pain and related opioid use are also due to strategic supply strategies, first by the pharmaceutical industry and subsequently by drug traffickers, who followed the market. The outcome was literally a perfect storm…

…Our latest work highlights the intersect between particular demographic cohorts and places (Graham and Pinto, 2019). We find, for example, that prime aged males out of the labor force (OLF) are a particularly vulnerable group, with white OLF males being the most vulnerable, as evidenced by their very low markers of well-being. They are heavily represented in the heartland, and are more likely to be living with their parents than are either minority OLF males or white OLF women. Time use surveys show that they spend a disproportionate amount of time playing video games or on the internet. They are also much more likely to be on opioids, to report pain, and to be on disability than the average.

Economic disruption from the pandemic has crushed communities across the US. Given the clear connection between economic despair and opioid abuse, COVID-19 has introduced the ingredients for a new surge in opioid overdoses.

Beyond the economic pain felt on Main Street, COVID-19 introduces a new variable that is likely to further drive opioid abuse. Decisions to delay elective surgeries by hospitals which were scrambling to deal with the influx of COVID patients may push opioid abuse to new levels, as explained by this piece from Fortune:

Knee replacement. Cancer surgeries. Organ transplants. Worldwide, tens of millions of elective surgeries have been postponed because of the coronavirus. Public health officials have had to balance patients’ urgent need for treatment against the very real danger of potentially immune-compromised individuals being exposed to the virus in a hospital setting, and the need to reserve hospital capacity for COVID-19 patients.

But the decision to postpone these so-called elective surgeries may have severe consequences—including deepening the opioid crisis. Based on what we already know about the connection between preoperative pain management and opioid dependency, the coronavirus pandemic is creating a perfect storm…

…When most people hear the word “elective,” they typically assume that means “cosmetic.” But in hospital terms, an elective surgery is simply any surgery that’s scheduled—in other words, not an emergency. In most cases, these are not cosmetic procedures; they are urgently needed surgeries to deal with serious medical issues. And right now, all kinds of procedures, including cancer surgeries, organ transplants, and other lifesaving treatments, have been postponed. Some hospitals have started scheduling elective surgeries again, but the very real risk of a second wave of coronavirus cases could put these patients at risk once more.

The population potentially at risk is enormous: In a typical year, 51 million people have inpatient surgery, whether elective or emergency, and over 80% of them are prescribed opioids after surgery—even when the surgery was low risk. Most patients with upcoming surgeries are prescribed opioids to manage their pain while awaiting treatment. For example, opioids are commonly prescribed for hip, knee, and shoulder surgeries; for neurosurgical and orthopedic spine patients (including people suffering from chronic back pain); for colorectal surgeries, including tumor removals; and for thoracic, head, and neck cancer patients.

Delaying surgery means patients will be taking these medications for longer before they’re treated, greatly increasing the odds that they’ll become dependent. Even patients who’ve never used opioids before surgery have a 10% chance of becoming dependent. But patients who’ve been using opioids to manage pain before surgery have a 70% chance of remaining on opioids years later.

Policymakers should be ready to deploy novel approaches to treating the epidemic as it rears its head post-pandemic. But given their demonstrated shortcomings in dealing with public health crises, I’m not holding my breath for policymakers to craft a successful strategy on opioid abuse. It will be interesting to see if private sector entrepreneurs can develop new business models to meet this moment.

//

Please don’t sue me:

This content is being made available for educational purposes only and should not be used for any other purpose. The information contained herein does not constitute and should not be construed as an offering of advisory services or an offer to sell or solicitation to buy any securities or related financial instruments in any jurisdiction. Certain information contained herein concerning economic trends and performance is based on or derived from information provided by independent third-party sources. The author believes that the sources from which such information has been obtained are reliable; however, the author cannot guarantee the accuracy of such information and has not independently verified the accuracy or completeness of such information or the assumptions on which such information is based.